Tax Fairness Vision

What Is Tax Fairness?

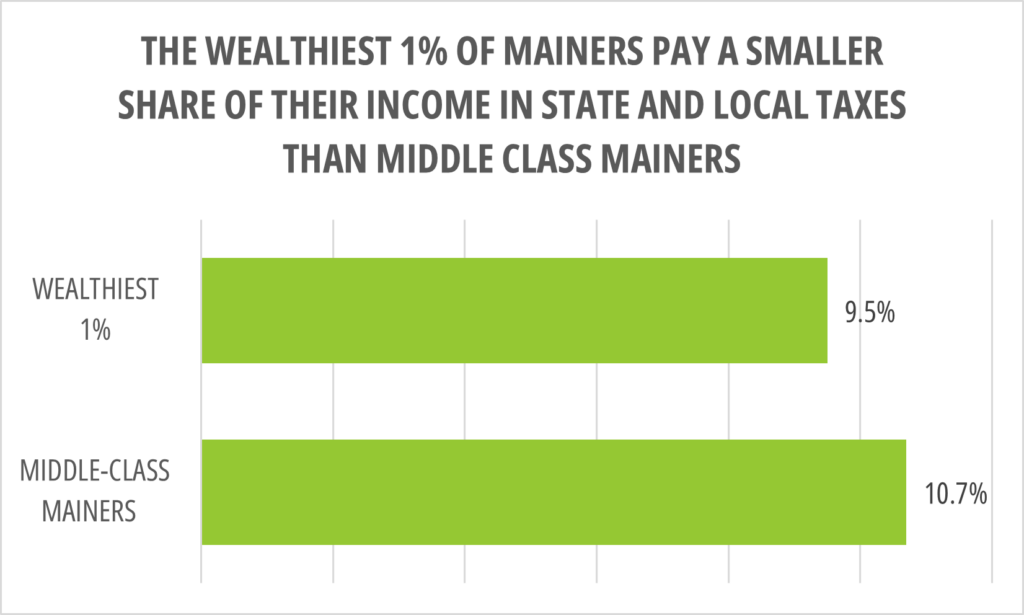

Mainers know that the challenges facing our communities need a response big enough to meet the moment. Whether it’s a housing crisis, direct care workforce shortages, or crumbling roads and bridges, the best way to make a difference is to confront them as a state. But for decades wealthy individuals and corporations have stacked the deck to avoid paying taxes, forcing the rest of us to pick up the slack while leaving important cornerstones of our society, like schools and public safety, underfunded.

Over decades, well-connected special interests manipulated our tax code to give breaks to those at the top – and our...

Posted by Mainers For Tax Fairness on Wednesday, May 26, 2021

How Can We un-rig the tax code & Make it fair?

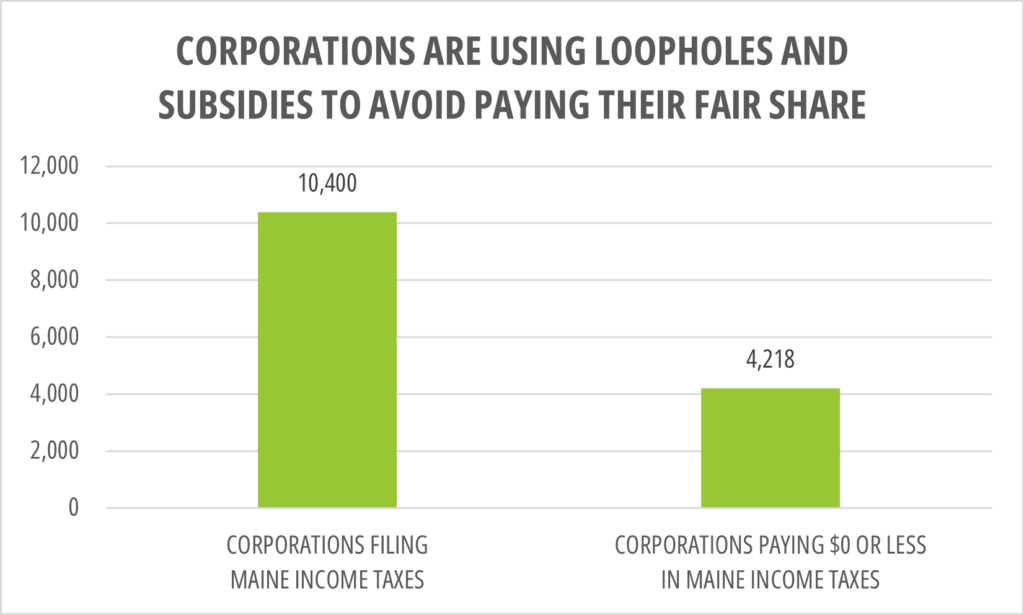

Time and time again, people fighting for solutions to these problems are told there is no money while new loopholes are created for already-prosperous corporations. This harms both working families and small businesses who cannot compete with their own army of lawyers and accountants.

We can and must change our tax system to bring more fairness to how we raise money and adequately fund the investments that will determine our future prosperity. Here is how we can do it.

Increase the taxes on the ultra rich

Prioritizing Working Families

Close Tax Loopholes

Multi-National Corps Pay What They Owe

Policy Solutions

All people and communities do better when everyone has the resources they need to prosper and thrive. Decisions about tax policy affect whether we have the resources to keep money flowing to families, towns, and our economy.

Taxes like the income tax, sales tax, and property tax are how we all pitch in to pay for those things that create a better quality of life for all of us: schools, housing, transportation, health care, clean air and water, parks, and family supports like food and child care assistance that make sure nobody gets left behind.